Among the many many issues nobody ever warns you about shifting abroad is how managing cash immediately turns into a large headache.

Most expats I do know right here in Australia now use their Australian checking account as their major cash hub, since they receives a commission in Australian {dollars} and spend in Australian {dollars}. Straightforward peasy.

However for me, and I’m guessing many different Individuals, switching over utterly to a overseas checking account isn’t a viable answer. I want to make sure I’ve sufficient cash in my US checking account to cowl two main month-to-month funds: scholar loans and bank card payments.

I’m not capable of pay both of those payments from my Aussie checking account, and I’m unwilling to eliminate my American bank card due to all of the factors and journey perks it affords (say what you’ll concerning the US, however we’ve the very best bank cards for journey hacking!). Due to this fact, I want to maneuver cash from my Aussie checking account to my American checking account frequently.

Once I first moved right here 3 years in the past, I investigated a number of totally different choices for cash transfers earlier than discovering THE BEST approach to switch cash to my US checking account. Right here’s what it appears like while you need to switch AU$5000 to a US checking account a number of alternative ways:

My first thought was to simply switch cash straight from my Australian checking account (beforehand CommBank) to my US checking account (Wells Fargo) by way of financial institution switch. Little did I do know I’d be hit with not one however TWO financial institution charges:

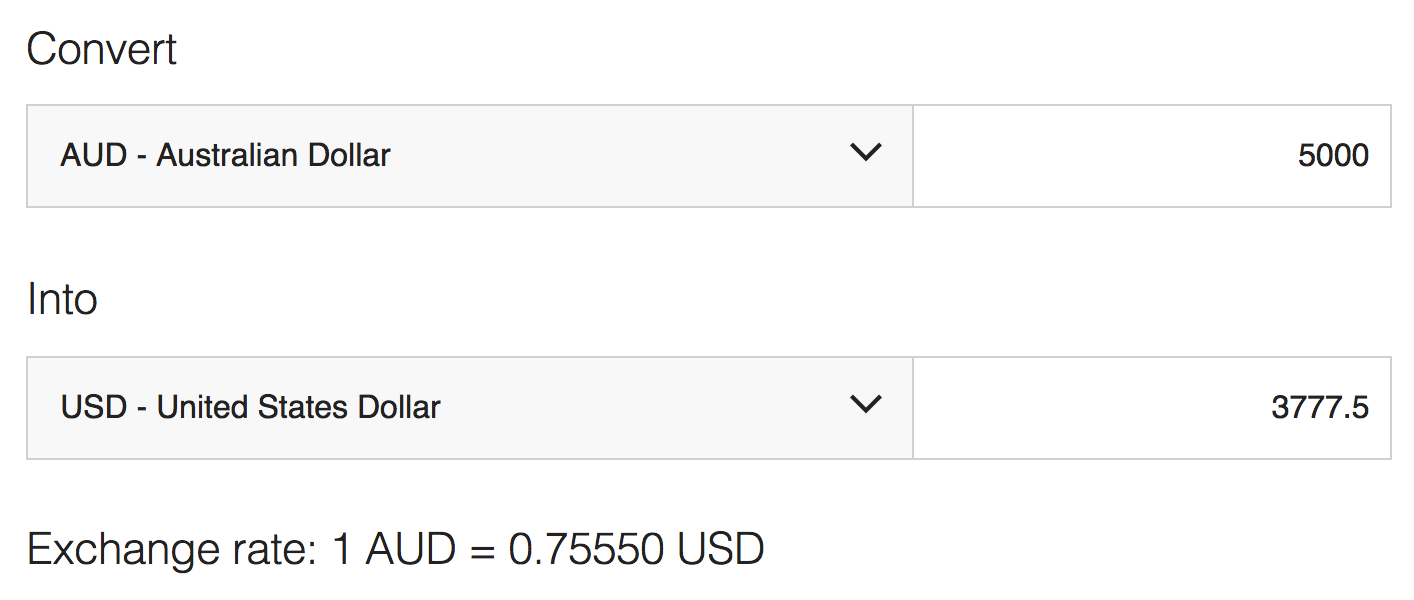

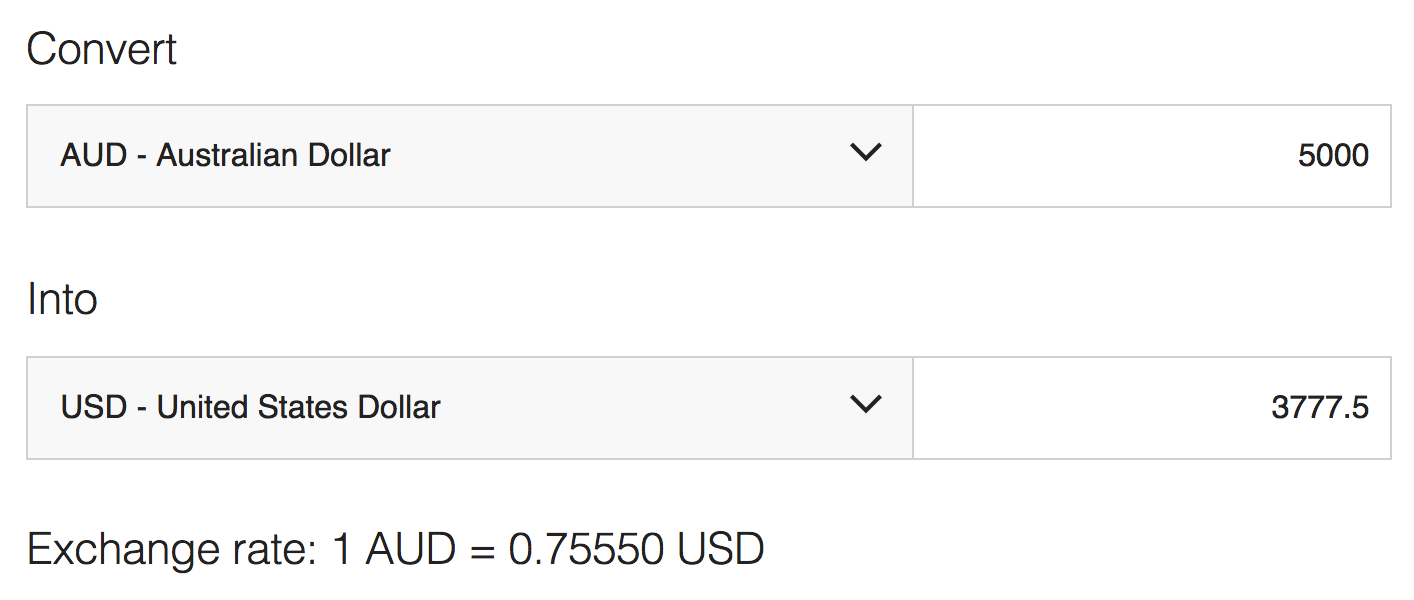

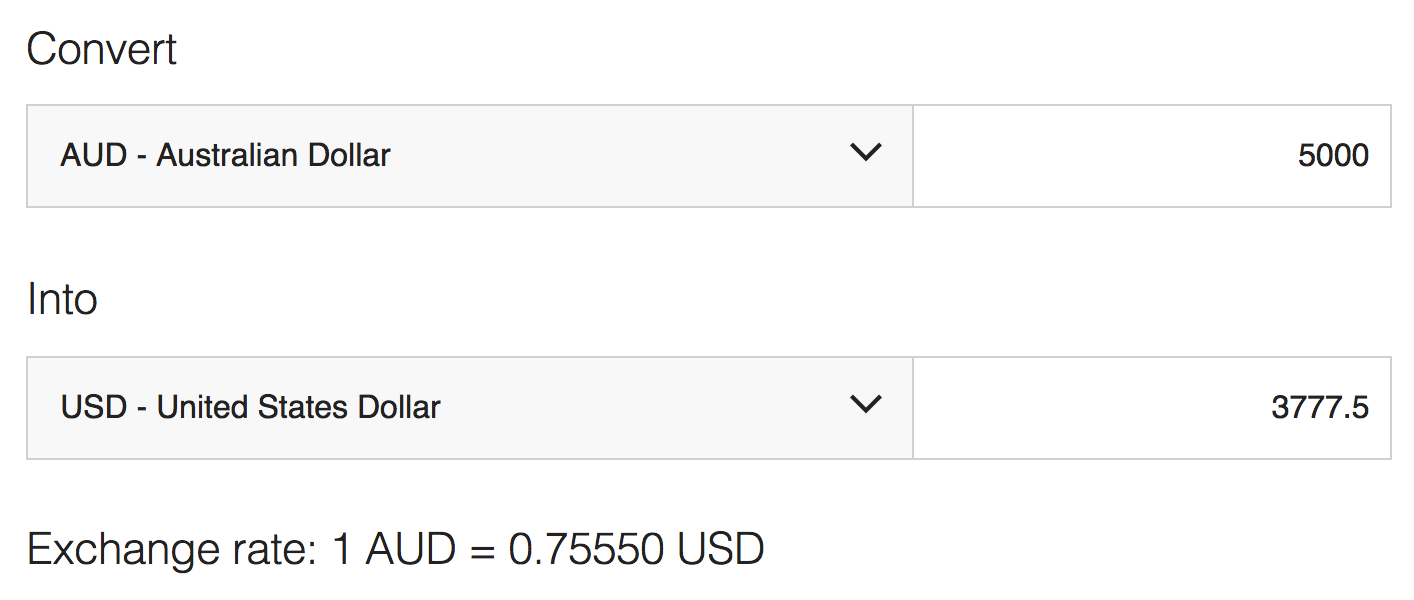

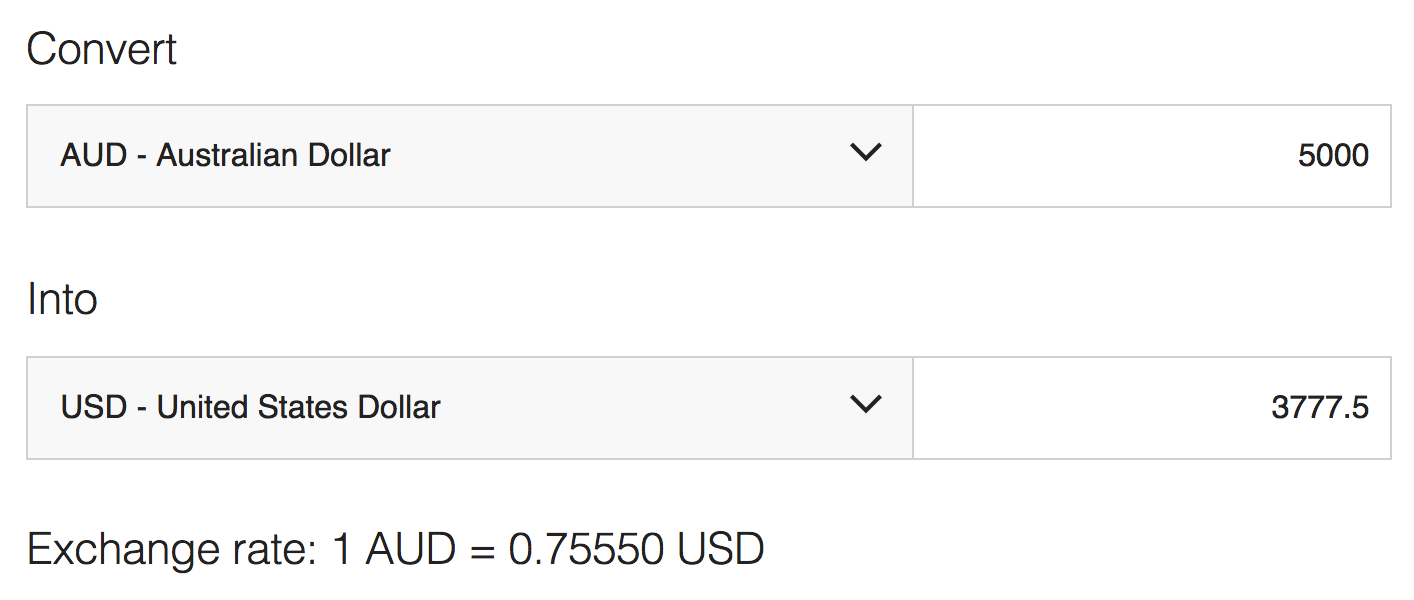

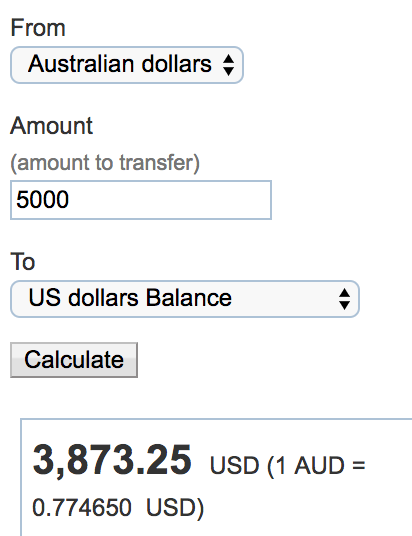

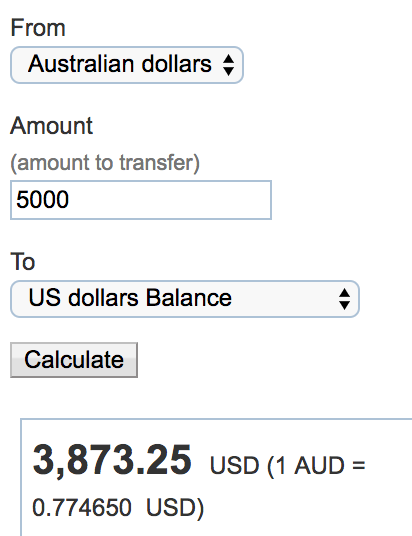

On high of being hit with double charges, the change charge for a global financial institution switch (at the least with CommBank) is totally atrocious.

CommBank change charge.

TOTAL USD EXCHANGED: US$3777.50 – US$9 payment to ship – US$16 payment to obtain = $3752.50

Subsequent, I took to PayPal – a platform I’ve used earlier than to make and obtain funds with relative ease.

As a way to transfer cash from my Aussie account to my US account, I would want to create a brand new PayPal account on the Australian PayPal web site and hyperlink it to my Australian checking account. Then, I may switch cash from this new Aussie PayPal account to my outdated US PayPal account. That’s barely tedious, however not too dangerous.

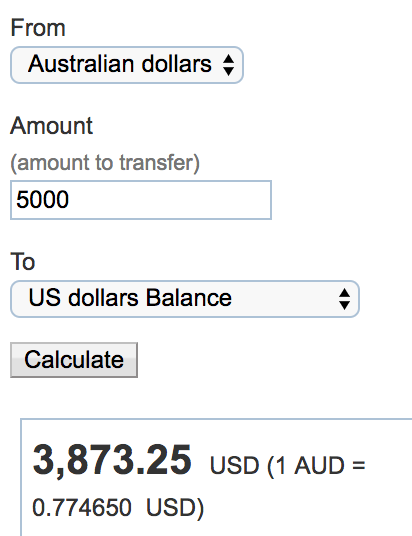

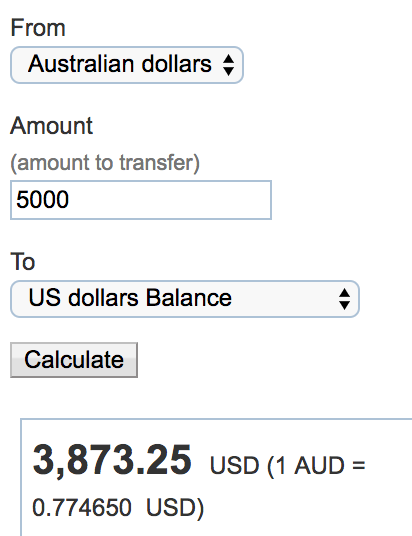

The worst half, although, occurs on the receiving finish of the PayPal switch. Whenever you obtain a global cash switch, PayPal fees you a payment (relying on the foreign money) and converts the cash at a horrible change charge.

If I have been to switch AUD into my US PayPal account, PayPal would cost me 1% of that quantity as a payment. So when shifting $5000 over, I’d must pay $50 for the switch itself. Um, are you able to say massive fats NOPE? AND, so as to add insult to harm, I’d lose much more cash as soon as I exchanged AUD to USD utilizing PayPal’s terrible change charge.

I feel PayPal is ok to make use of in the event you’re shifting over small quantities of cash, however the bigger the quantity the extra you’ll find yourself paying as a payment. For expats shifting over massive chunks of their wages to an abroad checking account, PayPal simply isn’t a wise choice.

PayPal change charge.

TOTAL USD EXCHANGED: US$3,873.25 – AU$50 payment to ship = $3834.52

Totally exasperated with the above choices and the concept of throwing away upwards of $1000 a 12 months on varied cash switch charges, I mercifully discovered about one other worldwide cash switch choice from an outdated flatmate I had after I first moved to Sydney. He instructed CurrencyFair, a peer-to-peer on-line market that permits you to promote foreign money in change for getting one other foreign money from another person.

CurrencyFair basically cuts out the center man (the financial institution), fees a a lot smaller payment (simply €3, or ~US$3.68), and exchanges the cash at an excellent charge. In addition they declare to be as much as 8 instances cheaper than banks with regards to worldwide cash transfers. That was about all I wanted to listen to to offer it a strive!

Screenshot of my most up-to-date transactions. It solely takes a day for the cash to make it to my financial institution as soon as it lands in CurrencyFair – too simple!

At first I used to be somewhat confused by the peer-to-peer market factor: would I be interacting and negotiating with different individuals in an effort to switch my cash via? It seemed like a little bit of a problem to me. BUT, in actuality, transferring funds via CurrencyFair seems like doing an everyday ol’ financial institution switch. It couldn’t get a lot simpler!

With each of my financial institution accounts linked to CurrencyFair, the method is roughly as follows and takes about 2 enterprise days to finish:

I’ve been utilizing and loving CurrencyFair for the previous 2.5 years. It’s the solely method I switch cash from Australia to the US to pay all my payments. The ONE adverse I’ve discovered, although, is that not all currencies can be found for transferring (see full record here). This personally doesn’t have an effect on me, but it surely may very well be a problem for these from or residing in sure international locations.

The excellent news is that they’ve been including an increasing number of currencies to their record through the years: living proof, after I first heard about CurrencyFair in early 2015, USD wasn’t an choice… however then a number of months later it was, and I used to be capable of begin utilizing their service.

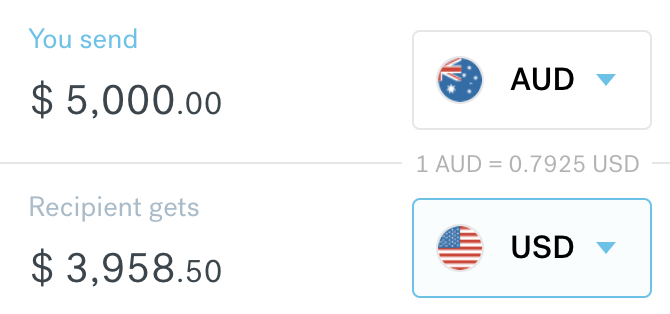

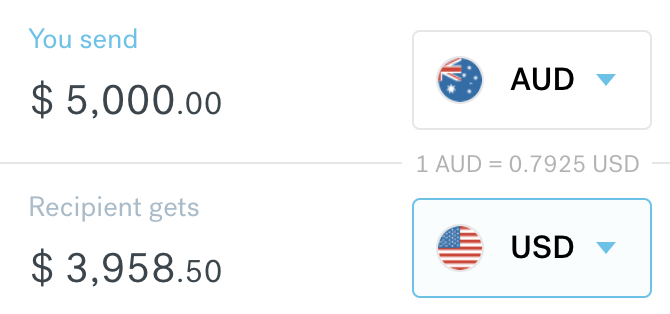

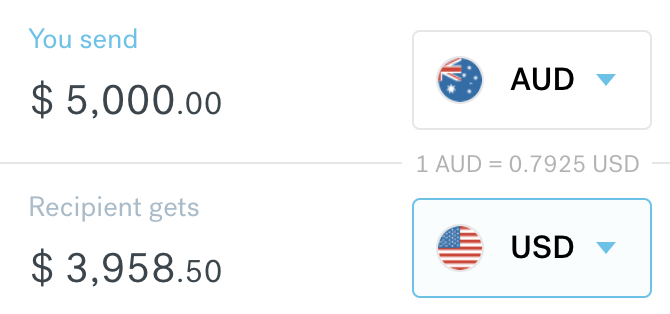

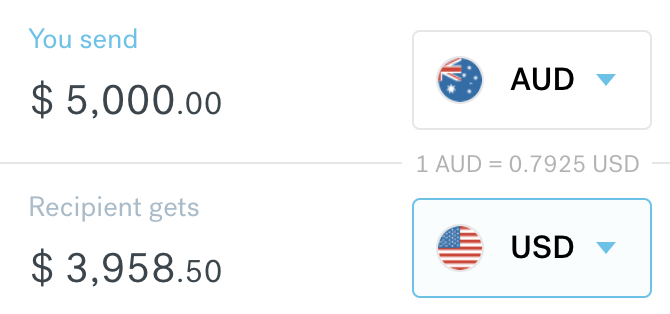

CurrencyFair change charge.

TOTAL USD EXCHANGED: US$3958.50 – €3 payment to ship = $3954.82

Right here’s how a lot cash would find yourself in my US checking account if I have been to switch AU$5000 proper now (sixteenth January 2018) utilizing the three choices examined above:

CurrencyFair saves me $200 over a traditional worldwide financial institution switch. Multiply that by, let’s say, 6 transfers in a 12 months (in all probability about what I common) and I save over $1200 per 12 months. THAT IS INSANE.

If you happen to’re a fellow expat making an attempt to kind out their cash state of affairs between international locations, I wholeheartedly advocate utilizing CurrencyFair as the most cost effective approach to ship cash internationally. It’s the most effective methods I do know to save cash in Australia. Let me know when you have any questions on it within the feedback and I’ll gladly provide help to out!

Most expats I do know right here in Australia now use their Australian checking account as their major cash hub, since they receives a commission in Australian {dollars} and spend in Australian {dollars}. Straightforward peasy.

However for me, and I’m guessing many different Individuals, switching over utterly to a overseas checking account isn’t a viable answer. I want to make sure I’ve sufficient cash in my US checking account to cowl two main month-to-month funds: scholar loans and bank card payments.

I’m not capable of pay both of those payments from my Aussie checking account, and I’m unwilling to eliminate my American bank card due to all of the factors and journey perks it affords (say what you’ll concerning the US, however we’ve the very best bank cards for journey hacking!). Due to this fact, I want to maneuver cash from my Aussie checking account to my American checking account frequently.

Once I first moved right here 3 years in the past, I investigated a number of totally different choices for cash transfers earlier than discovering THE BEST approach to switch cash to my US checking account. Right here’s what it appears like while you need to switch AU$5000 to a US checking account a number of alternative ways:

How NOT To Switch Cash

Financial institution Switch

My first thought was to simply switch cash straight from my Australian checking account (beforehand CommBank) to my US checking account (Wells Fargo) by way of financial institution switch. Little did I do know I’d be hit with not one however TWO financial institution charges:

- CommBank fees AU$12 (~US$9) per financial institution switch while you debit out of your Aussie account and change to a overseas foreign money.

- Wells Fargo fees US$16 to obtain a overseas financial institution switch.

On high of being hit with double charges, the change charge for a global financial institution switch (at the least with CommBank) is totally atrocious.

CommBank change charge.

TOTAL USD EXCHANGED: US$3777.50 – US$9 payment to ship – US$16 payment to obtain = $3752.50

PayPal

Subsequent, I took to PayPal – a platform I’ve used earlier than to make and obtain funds with relative ease.

As a way to transfer cash from my Aussie account to my US account, I would want to create a brand new PayPal account on the Australian PayPal web site and hyperlink it to my Australian checking account. Then, I may switch cash from this new Aussie PayPal account to my outdated US PayPal account. That’s barely tedious, however not too dangerous.

The worst half, although, occurs on the receiving finish of the PayPal switch. Whenever you obtain a global cash switch, PayPal fees you a payment (relying on the foreign money) and converts the cash at a horrible change charge.

If I have been to switch AUD into my US PayPal account, PayPal would cost me 1% of that quantity as a payment. So when shifting $5000 over, I’d must pay $50 for the switch itself. Um, are you able to say massive fats NOPE? AND, so as to add insult to harm, I’d lose much more cash as soon as I exchanged AUD to USD utilizing PayPal’s terrible change charge.

I feel PayPal is ok to make use of in the event you’re shifting over small quantities of cash, however the bigger the quantity the extra you’ll find yourself paying as a payment. For expats shifting over massive chunks of their wages to an abroad checking account, PayPal simply isn’t a wise choice.

PayPal change charge.

TOTAL USD EXCHANGED: US$3,873.25 – AU$50 payment to ship = $3834.52

Greatest approach to switch cash: CurrencyFair

Totally exasperated with the above choices and the concept of throwing away upwards of $1000 a 12 months on varied cash switch charges, I mercifully discovered about one other worldwide cash switch choice from an outdated flatmate I had after I first moved to Sydney. He instructed CurrencyFair, a peer-to-peer on-line market that permits you to promote foreign money in change for getting one other foreign money from another person.

CurrencyFair basically cuts out the center man (the financial institution), fees a a lot smaller payment (simply €3, or ~US$3.68), and exchanges the cash at an excellent charge. In addition they declare to be as much as 8 instances cheaper than banks with regards to worldwide cash transfers. That was about all I wanted to listen to to offer it a strive!

Screenshot of my most up-to-date transactions. It solely takes a day for the cash to make it to my financial institution as soon as it lands in CurrencyFair – too simple!

At first I used to be somewhat confused by the peer-to-peer market factor: would I be interacting and negotiating with different individuals in an effort to switch my cash via? It seemed like a little bit of a problem to me. BUT, in actuality, transferring funds via CurrencyFair seems like doing an everyday ol’ financial institution switch. It couldn’t get a lot simpler!

With each of my financial institution accounts linked to CurrencyFair, the method is roughly as follows and takes about 2 enterprise days to finish:

- Log into CurrencyFair and provoke a switch.

- Log into my Aussie checking account and switch funds in AUD to CurrencyFair. (Crucial that within the switch notes you embrace your CurrencyFair reference quantity, in order that they know who the cash is coming from and may match it to your account.)

- CurrencyFair mechanically exchanges the funds to USD and transfers to my US checking account (although in the event you don’t need this to be executed mechanically, you’ll be able to simply switch into CurrencyFair and specify that the funds sit there till you go in and inform them to switch to your different account… helpful in the event you’d relatively wait till the change charge is extra favorable!).

I’ve been utilizing and loving CurrencyFair for the previous 2.5 years. It’s the solely method I switch cash from Australia to the US to pay all my payments. The ONE adverse I’ve discovered, although, is that not all currencies can be found for transferring (see full record here). This personally doesn’t have an effect on me, but it surely may very well be a problem for these from or residing in sure international locations.

The excellent news is that they’ve been including an increasing number of currencies to their record through the years: living proof, after I first heard about CurrencyFair in early 2015, USD wasn’t an choice… however then a number of months later it was, and I used to be capable of begin utilizing their service.

CurrencyFair change charge.

TOTAL USD EXCHANGED: US$3958.50 – €3 payment to ship = $3954.82

The Backside Line

Right here’s how a lot cash would find yourself in my US checking account if I have been to switch AU$5000 proper now (sixteenth January 2018) utilizing the three choices examined above:

- Financial institution Switch: US$3752.50

- PayPal: US$3834.52

- CurrencyFair: US$3954.82

CurrencyFair saves me $200 over a traditional worldwide financial institution switch. Multiply that by, let’s say, 6 transfers in a 12 months (in all probability about what I common) and I save over $1200 per 12 months. THAT IS INSANE.

If you happen to’re a fellow expat making an attempt to kind out their cash state of affairs between international locations, I wholeheartedly advocate utilizing CurrencyFair as the most cost effective approach to ship cash internationally. It’s the most effective methods I do know to save cash in Australia. Let me know when you have any questions on it within the feedback and I’ll gladly provide help to out!

EXCLUSIVE TO FRUGAL FROLICKER READERS:

Sign up to CurrencyFair using this link and your first 3 transfers are free!